How to Create a Debt Repayment Plan That Works

Discover practical steps to create a personalized debt repayment plan that aligns with your financial goals and lifestyle. Break down your debt into manageable steps, learn strategies to pay it off efficiently, and build habits to stay debt-free.

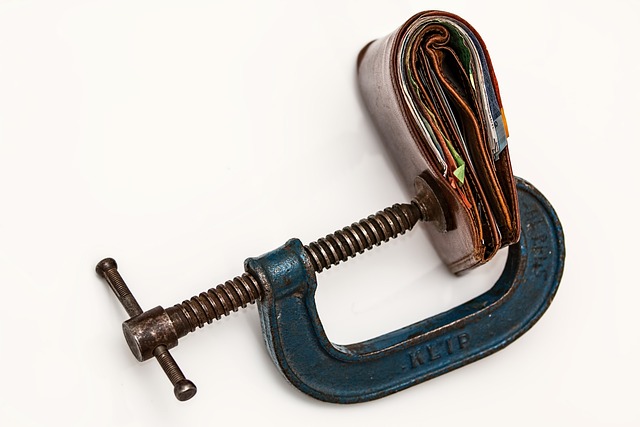

Tackling debt can feel overwhelming, but creating a debt repayment plan tailored to your financial situation can be a game-changer. A clear and actionable plan helps you see progress, build motivation, and ultimately take control of your finances. Here’s a step-by-step guide to get started.

Step 1: Take Stock of Your Debts

The first step is to understand exactly what you're dealing with. List out all your debts, including credit cards, personal loans, student loans, and any other outstanding balances. For each debt, note the amount owed, the interest rate, and the minimum monthly payment. Having this information in one place will give you a clear picture of your financial obligations.

Tips:

Use a spreadsheet or debt management app to keep everything organized.

Don’t forget small debts; every amount counts toward your total.

Step 2: Prioritize Your Debts

Once you have a full list of your debts, the next step is to decide how to prioritize them. There are two popular methods for debt repayment: the Avalanche and the Snowball methods.

Avalanche Method: Focuses on paying off debts with the highest interest rates first. This method minimizes the amount you pay in interest, making it the fastest way to save money.

Snowball Method: Focuses on paying off the smallest debts first. This approach helps you gain momentum by seeing quick wins, which can be incredibly motivating.

Choosing the Right Strategy

If you're motivated by seeing quick results, the Snowball method may be more motivating. However, if your priority is minimizing interest, the Avalanche method is likely the better choice.

Step 3: Set Realistic Monthly Payments

To create a debt repayment plan that sticks, decide how much you can realistically pay toward your debts each month. Start by calculating your discretionary income—the amount left over after covering essential expenses (like rent, groceries, and utilities).

Adjusting Your Budget

If your discretionary income is low, see if you can adjust your budget to free up more money for debt repayment. Consider reducing non-essential expenses, like dining out or subscription services, and redirect that money toward your debts.

Step 4: Create a Timeline

Once you have a monthly payment amount and have chosen your repayment method, create a timeline for each debt. This step helps you see when you can expect to pay off each balance, making it easier to stay on track.

Benefits of a Timeline:

Having a target date can be incredibly motivating.

It helps you stay accountable by giving you a clear path to follow.

With these foundational steps in place, you’ll have a clearer understanding of your debts and a plan to tackle them. But the journey doesn't end here. Part two will focus on strategies to increase your income, cut expenses, and develop habits that will keep you on track to a debt-free future.

After building a debt repayment foundation, it’s time to focus on ways to accelerate the process. In this part, we’ll dive into techniques for maximizing payments, staying motivated, and preparing for life after debt.

Step 5: Find Ways to Boost Your Income

Increasing your income can make a huge difference in how quickly you pay off debt. Look for opportunities to earn more, whether through part-time work, freelance projects, or even selling items you no longer need.

Ideas to Boost Income:

Freelance Work: Sites like Upwork or Fiverr allow you to monetize your skills.

Part-time Job: A few extra hours a week can significantly boost your monthly income.

Selling Items: Look around your home for items you can sell online, like electronics or furniture.

Step 6: Cut Expenses Creatively

Reducing your expenses is another way to free up more money for debt repayment. However, this doesn’t mean sacrificing your quality of life. Look for smart ways to cut back without feeling deprived.

Expense-Cutting Ideas:

Meal Prep: Planning and cooking meals at home can save money and reduce food waste.

Subscription Audit: Cancel or pause subscriptions you’re not using regularly.

Utility Savings: Simple actions, like using energy-efficient bulbs or adjusting your thermostat, can reduce utility bills.

Step 7: Set Up an Emergency Fund

It might seem counterintuitive to save money while paying off debt, but having a small emergency fund—typically $500 to $1,000—can help you avoid going further into debt when unexpected expenses arise. This cushion gives you peace of mind and prevents derailing your repayment plan.

Why It Works:

An emergency fund allows you to handle unexpected expenses (like a car repair or medical bill) without needing to use credit cards or loans. Think of it as a financial safety net that keeps you on track.

Step 8: Track Your Progress and Celebrate Wins

Keeping track of your progress is essential. Celebrate small milestones—like paying off a credit card or hitting a new balance goal. These moments reinforce your commitment and boost motivation.

Ways to Stay Engaged:

Debt Tracker App: Many apps help you monitor your progress, sending reminders and visualizing your progress.

Set Rewards: Treat yourself when you reach specific milestones. A small reward can keep you motivated and make the journey more enjoyable.

Step 9: Develop Habits to Stay Debt-Free

Once you’re close to paying off your debts, start planning for a future without debt. This could involve setting up automatic savings or practicing mindful spending. Adopting these habits now can help you avoid falling back into debt.

Future Planning Tips:

Budgeting: Stick to a budget that includes savings goals.

Mindful Spending: Reflect on each purchase and consider whether it aligns with your financial goals.

Automate Savings: Automatically transfer a portion of your income into a savings account.

Looking Ahead: Enjoying Financial Freedom

Achieving financial freedom requires effort, but the peace of mind and independence it brings is worth every step. By following this plan, you’re not just paying off debt—you’re building a foundation for long-term financial stability.